|

养老投资

嘉实将养老金业务定位为长期战略业务,深度涉足包括主权财富和基本养老保险基金、企业/职业年金、养老目标基金在内的三大养老业务 养老投资主页 |

|---|

本文相关基金

本文相关基金

更多

相关资讯

相关资讯

嘉实动态

嘉实动态

China’s Pathways to Net Zero will open up tremendous investment opportunities

Overview: carbon Neutrality Goals for China

China’s rapid ascent to becoming the world’s second-largest economy, it also became the largest carbon emitter. At the general debate of the 75th session of United Nations General Assembly on 22nd September 2020, China’s President Xi Jinping announced China’s national pledge to peak carbon emission before 2030 and to achieve carbon neutrality by 2060, marking the beginning of China’s ambitious multi-decade journey to transform its economic and energy structures. Net zero will be the guiding principle for policymaking for the upcoming decades and will be comprehensively embedded into structural reforms, investment policies, and innovation priorities. With the 14th Five-Year-Plan (2021-2025) to be approved during the Two Sessions in March, the Year of 2021 is bound to be the inflection point as policy support and developments are underway to achieve China’s climate ambitions. In this report, we will examine China’s key pathways towards carbon neutrality through the lens of macro and sectorial developments for emissions control.

Carbon neutrality in China: challenges and opportunities

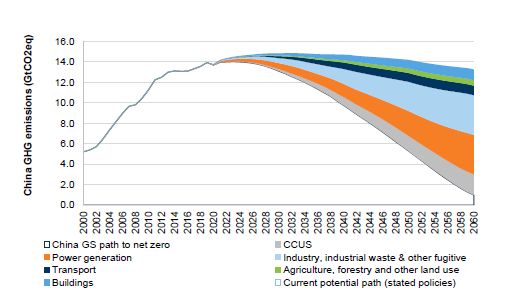

With its carbon emission accounting for 28% of global[1], China cannot achieve neutrality without meaningful decoupling economic growth and carbon emissions. Unlike many developed countries where carbon emissions have already peaked and started to decline, China’s emission level is still on the rise. Furthermore, against the backdrop of COVID-19, some local governments may still be keen to onboard energy and emissions intensive, high-emission projects to boost short-term economic growth. This presents some level of unpredictability for the low carbon transition during the 14th Five-Year-Plan period. Overall, the path to net zero will require a radical change in the country’s energy mix and energy consumption structure, as depicted by Goldman Sachs’ emission reduction path (Fig.1).

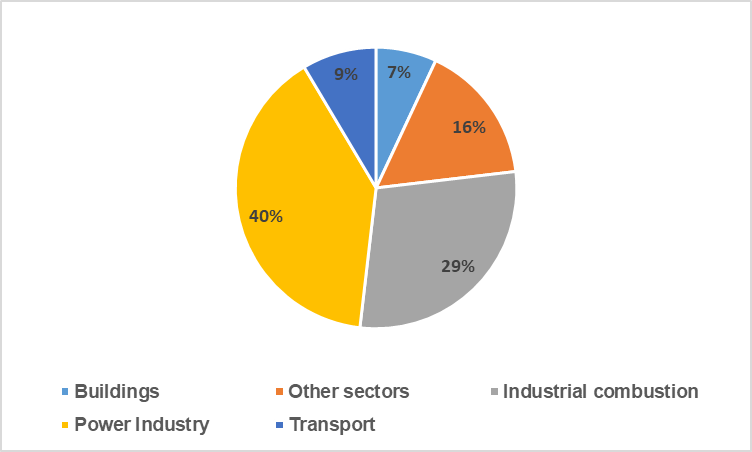

Industrial combustion and power generation contribute to more than 69% of China’s greenhouse gas emissions (Fig.2).

Fig.1 China anthropogenic GHG emissions path to net zero (excl. natural sinks)

Source: European Commission Joint Research Centre (JRC). Emission Database for Global Atmospheric Research (EDGAR) release version 5.0, FAO, Goldman Sachs Global Investment Research

Fig.2 China's GHG emission by sector

Source: Emission Database for Global Atmospheric Research (EDGAR) release version 5.0, Harvest Fund Management

Power generation alone contributes to 40% of China’s carbon emissions, and is the most critical hurdle to achieve carbon neutrality[2]. Considering the nation’s rich coal reserves, energy security, and stability of energy supplies, coal will likely remain as the main source of energy in the near term, but is expected to decrease to around 52% in 2025, according to Hongpu Kang, Chief Scientist from China Coal Technology & Engineering Group[3]. On the other hand, renewable energy capacity development will be the key driver for the decarbonization of the power sector. The committed timeline has urged the nation to fast-track its renewables development. Currently, the widely-held consensus indicates that non-fossil fuel energy will comprise at least 80% of China’s energy mix by 2050[4].

Strenuous as it might sound, this fundamental change of China’s energy mix will bring about both challenges and opportunities. Low carbon transition will require substantial funds and investments to develop green infrastructure, which is estimated to be around 139 trillion RMB leading up to 2060[5]. More than half will be dedicated to decarbonizing the power sector, including development of renewable energy, power grids, and power storage.

Additionally, by further developing technologies such as wind and solar power generation, electrolytic hydrogen production, and Carbon Capture and Storage (CCUS), China can significantly accelerate its transition into a cleaner energy structure while reducing its reliance on imported non-renewable energy sources. The output value of the country's low carbon industries, namely industries dedicated to a low-energy, low-pollution, low-emission economy, is expected to reach RMB 23 trillion in 2030, accounting for more than 16% of GDP, according to expert Qimin Chai from National Center for Climate Change Strategy and International Cooperation[6].

Experts also anticipate China’s path towards its net zero ambition could facilitate the creation of 40 million jobs by 2060 across sectors5, with direct impact on job market in sustainable energy sectors. This will significantly offset the net losses of job in traditional energy sectors such as coal mining and processing.

Curbing emissions through market mechanism: the rise of the world’s largest national ETS

Carbon pricing is widely considered to be a critical component for the efforts towards neutrality. While most of emission control have been achieved by administrative measures in the past, it would be of significant importance for China to speed up the establishment and improvement of the national carbon market. Building on the experience of pilot carbon trading programs in eight provinces and cities since 2013, China has rolled these into a national carbon market, giving rise to the world’s largest national emissions trading scheme (ETS). In November 2020, the Ministry of Ecological and Environment released two official documents, outlining systematic rules for carbon trading for the first time. The national ETS covers enterprises with annual greenhouse gas emissions of 26,000 tons of carbon dioxide equivalent and above (i.e., total energy consumption of about 10,000 tons of standard coal and above)[7], starting with 2,225 emitters in the power sector to participate in the first compliance cycle. During the 14th Five-Year-Plan, the scope of carbon market is anticipated to expand to 7 other key sectors including petrochemicals, chemicals, construction materials, steel, non-ferrous metals, paper manufacturing, and domestic aviation. Ultimately, the market pricing mechanism is expected to become a major force to drive meaningful carbon emissions reduction.

Significant challenges still lie ahead of the implementation of an effective carbon trading market. Apart from that the initial quota was set relatively high across the board, China’s ETS could see limited impact on corporate behavior in the absence of a mechanism to enable power plants to transfer its emission cost to their downstream consumers. Additionally, due to limited enterprise carbon reporting in 2019 and COVID-19 in 2020, there remains insufficient basis to substantiate the decisions made for corporate quota standards[8].

With that said, China should formulate policies and effective measures for timely enterprise carbon related reporting, where international experience and frameworks could be leveraged and combined with China’s own market conditions. As emphasized by Gao Li, Director of the Department of Climate Change, Ministry of Ecological Environment, a well-designed ETS will create better conditions for financial institutions to further promote green and low-carbon investment through the pricing power of the market[9].

Sector pathways towards net zero: featuring power, transportation and industrials

The key contributors to China’s neutrality target are sectors with the highest emissions, namely power generation, coal production, transportation, and industrials. They account for 80% of China’s total anthropogenic GHG emissions5. Therefore, the key to success will largely rely on the transformation towards renewable energy as well as electrification of road transportation and industrial energy consumption.

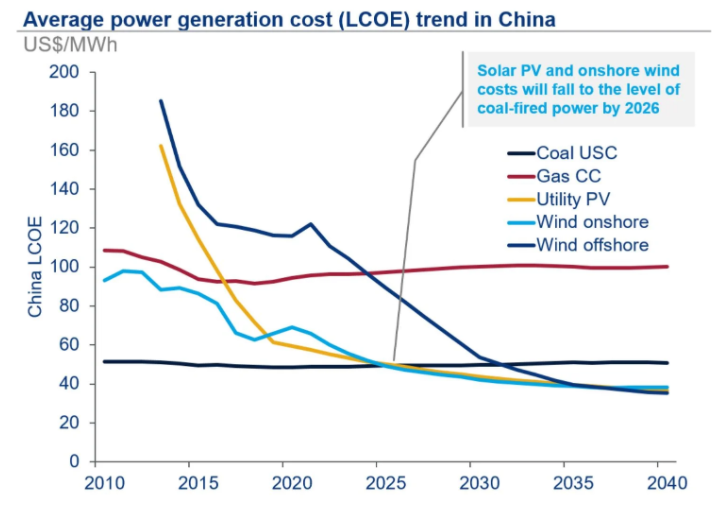

Power sector: the switch to renewable energy sources is the key to de-carbonize the power sector and has the potential to revolutionize China’s energy mix. The total demand for electricity in 2060 is expected to be 3x as of now, reiterating the importance of decarbonzation in power generating spectrum5. At the moment, utility scale of solar and onshore wind powers’ Levelized Cost of Energy (LCOE) is already comparable to the coal-fired power, which makes the mass adoption of solar and wind energy more cost effective in the immediate future. Additionally, China is well positioned to benefit from its leading position in the global solar supply chain: China produces 68% of world’s solar polysilicon and 90+% in ingot/wafers globally in 2019[10], with the top 5 Chinese solar panel producers with a total market share of 68% globally[11]. Upstream Chinese solar players are also expected to enjoy tailwinds from a global wake-up call to align with the 1.5℃ scenario in the post COVID-19 world. Besides, China’s investments in solar and wind power generation have topped the list, with one third of the world’s patents on renewable energy.

Fig.3 China’s solar and onshore wind LCOE reaches coal’s grid parity

Source: Wood Mackenzie

In light of these rapid developments, we expect the share of non-fossil fuel in the energy mix will continuously rise in the coming years. According to estimates, renewable energy installed capacity will likely rise by 600 GW with solar and wind increasing by 350GW[12] and 250 GW[13] respectively during 14th Five-Year-Plan, further reducing China’s reliance of imported Oil and Gas. In the mid-term, to peak carbon by 2030, power generated by fossil fuels will fall below 50% by 2030[14]. In the long-term to reach net zero, the non-fossil fuel capacity will need to reach 81% in 2060, as estimated by State Grid Energy Research Institute[15]. We anticipate the shift to renewable energies would accelerate and create more investment opportunities along the way.

Transportation: China has quickly emerged as a leader in the global electric vehicles (EV) value chain in the past few years. We anticipate China would build on the momentum and work towards systematic electrification of the transportation system albeit the sector contributing to only 9% of China’s GHG emission[16]. This would benefit from the rise of China’s middle class and resulting demand, relatively low-cost and the advancement in electrification technologies. According to Goldman Sachs, to achieve 30/60 carbon targets, it would require NEV penetration in the road transport fleet to reach 20% by 2030, close to 70% by 2040, 90% by 2050 and almost 100% by 206014. With ‘Measures for Parallel Administration of Corporate Average Fuel Consumption of Passenger Vehicle Sales Credit’ amended earlier this year, China is also expected to vigorously promote the development of new energy models as well as to significantly abate fuel efficiency through technologies such as 48V system, Atkinson cycle combustion and small-displacement vehicles[17].

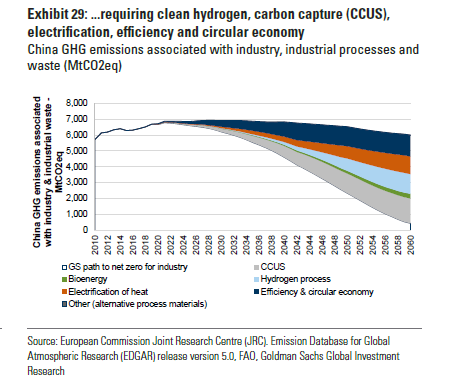

Fig.4 China’s anthropogenic GHG emissions associated with industry & industrial waste

Source: European Commissions Joint Research Centre (JRC), EDGAR, FAO, Goldman Sachs

Industrials: China has been taking tremendous efforts in energy efficiency improvements over the past decade, with most of its efficiency gains derived from the industry sector[18]. Apart from electrification through renewable energy, cutting-edge technologies such as hydrogen process are expected to make a considerable contribution towards decarbonization of the industrials sector. Leveraged effectively, hydrogen process could play a vital role in various industries including steel mills, chemicals and high temperature heat. On the other hand, Carbon Capture, Utilization and Storage (CCUS) technology will be critical to China’s decarbonization. A high penetration rate of CCUS technologies used in conjunction with measures on operational upgrade and retrofits for energy efficiency will significantly prompt China’s industrial upgrade, unleashing further potentials for the nation’s decarbonization process.

Summary: the road ahead

Recent history has manifested China’s resolution in achieving national environmental goals laid out in the past five-year plans. We also anticipate the push towards carbon neutrality in the coming decades will be translated into systematic formulation of policies and measures at national and local levels, and sector and company levels throughout the country. This will undoubtedly bring tremendous opportunities through significantly expanding investable low carbon sectors and technologies. We will discuss on the investment implications of China’s carbon neutrality in the following issuance of our research insights.

Fig.5 Recent climate related policies and administrative measures

Date | Ministry | Key Points |

Dec 18, 2020 | National Development and Reform Commission | Propelling governance on plastic pollution; Reinforce control on volume and intensity of energy consumption |

Dec 21, 2020 | Ministry of Ecology and Environment | Identified key areas for policy developments including local governments carbon peaking action plans and corporate emissions disclosure |

Dec 22, 2020 | National Energy Administration | Elevating energy supply; Upgrading China’s energy structure developments in solar, wind, water, nuclear, energy storage, coal efficiency improvements |

Dec 25, 2020 | People’s Bank of China | Advocacy to further develop a green finance system leading up to carbon peaking and neutrality |

Dec 28, 2020 | Ministry of Industry and Information Technology | Reducing production of crude steel, implementing Industrial low-carbon action and green manufacturing |

Jan 5, 2020 | Ministry of Ecology and Environment | Confirming that the first compliance cycle of China’s national ETS was effectively rolled out on January 1, 2021 |

Source: NDRC, MEE. NEA, PBoC, MIIT, Harvest compiled

Disclaimer

[1] Bloomberg (2020), 中国低碳进程提速

[2] Goldman Sachs (2021), Carbonomics: China Net Zero: The clean tech revolution

[3] http://www.ccoalnews.com/news/202001/15/c120778.html

[4] https://www.sohu.com/a/433466256_722664

[5] Goldman Sachs (2021), Carbonomics: China Net Zero: The clean tech revolution

[6] https://economy.gmw.cn/2021-01/18/content_34550389.htm

[7] https://www.ctvnews.ca/world/china-launches-carbon-emissions-trading-scheme-1.5290756

[8] Huang, D., Santikarn, M., Mok, R., Cui, Y., Wang, Y. and Liu, H. (2020). World Bank Blogs, How China’s national carbon market can support its transition to carbon neutrality.

[9] https://www.china5e.com/news/news-1104106-1.html

[10] 前瞻产业研究院(2021), 2020年H1中国光伏行业市场分析:多晶硅产量大幅上涨 光伏产品出口额下降 https://bg.qianzhan.com/report/detail/300/

[11] 华安证券(2021), 低成本和融资能力双轮驱动,多晶硅强者恒强--光伏行业系列报告之一:多晶硅

[12] http://www.cs.com.cn/xwzx/hg/202012/t20201211_6119524.html, ,

[13] https://www.ne21.com/news/show-156396.html

[14] Goldman Sachs (2021), Carbonomics: China Net Zero: The clean tech revolution

[15] 国网能源研究院(2021), 中国能源电力发展展望

[16] Crippa, M., Guizzardi, D., Muntean, M., Schaaf, E., Solazzo, E., Monforti-Ferrario, F., Olivier, J.G.J., Vignati, E., Fossil CO2 emissions of all world countries - 2020 Report, EUR 30358 EN, Publications Office of the European Union, Luxembourg, 2020, ISBN 978-92-76-21515-8, doi:10.2760/143674, JRC121460.

[17] https://zhuanlan.zhihu.com/p/30008296?from_voters_page=true

[18] BCG (2020), 中国气候路径报告:承前继后、坚定前行